Hello! I’m Sydney Thomas - a Principal at Precursor Ventures. Precursor is a Pre-Seed investment firm that has invested in high-growth companies like Finix, Modern Health, Incredible Health, The Athletic and over 200 others. I’m really excited to welcome you to the first of what I hope will be many e-mails from the Precursor crew.

Today, I want to talk to you about why I am so excited to invest in companies that are building for the long tail and share my process for doing diligence on these companies with the intention of inspiring other investors to explore this space.

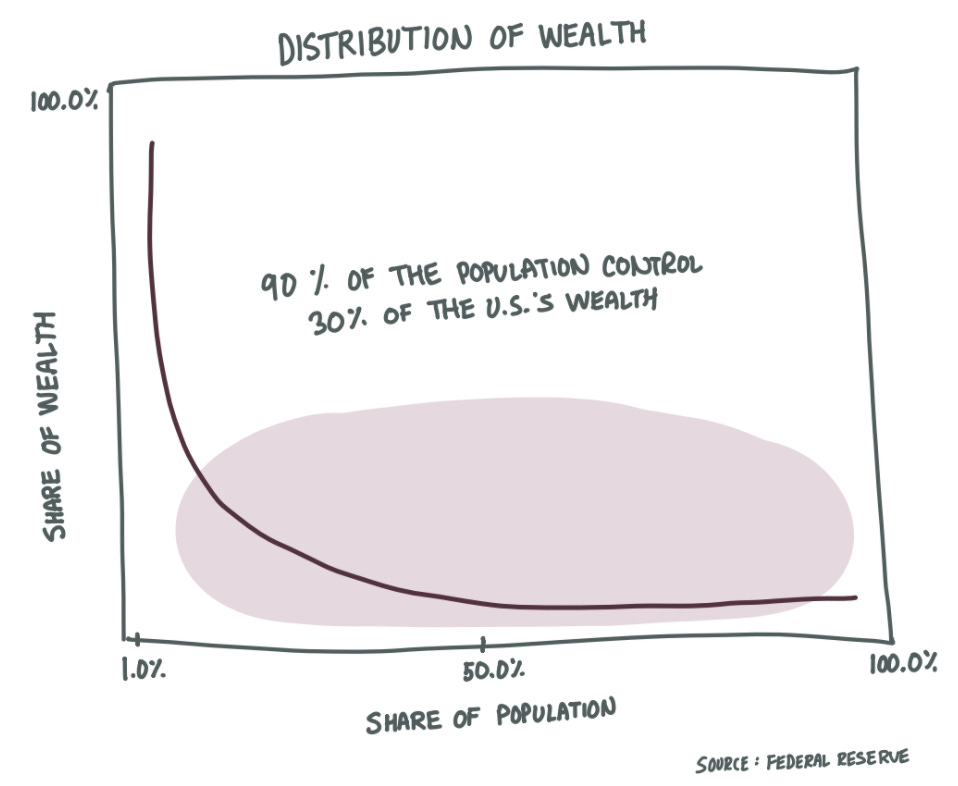

What is the “long tail”? Well, it can mean a lot of things to different people. To me, the long tail is a shorthand for describing this chart which has stubbornly stood the test of time1.

When I refer to the long tail, I’m literally referring to my family. I am someone who proudly identifies as having family across the entire income ladder. A short-hand that writer Tressie McMillan Cottom uses for this is, “I’m someone with cousins”2. Wal-Mart shoppers, social workers, teachers, truck drivers, small business owners, construction workers, Dunkin Donuts lovers, renters…. I’m interested in companies that are making life better for these folks.

If you've spoken with me before, you know that this work is a minor - ok major - obsession of mine. I’ve spent my entire decade-long career on this work and with this focus. I started my career interning for Congresswoman Barbara Lee where I was thrust into healthcare reform - it was the summer the ACA was passed. I moved on to working on tax legislation, which meant lobbying for a more progressive tax bill. I then moved on to help fundraise $50M to support NYC public schools. From there, I worked across mission-driven companies both large and small where I wore a lot of hats - helping with launch strategies, R&D and marketing.

After that, I started at Precursor where I worked with the founder, Charles, to build, launch and invest 3 funds totaling $100M+ in AUM and including 250+ companies. While early in my career, I have now spent the past 5 years researching, learning and reviewing companies that are building for the long tail. Over that time, I have reviewed thousands of companies in this space, made a podcast featuring some of them and invested in many of them as well.

Ok, let’s dig into how I do diligence on these companies…

1) Are you building on top of a broken legacy system or building a new system?

This is the first question I ask myself when reviewing a company building for the long tail. I have talked to a few folks who are building companies in this space that have accepted as true, the status quo. And what they're building is a way to make the status quo more palatable for the long tail.

I think this is short-sighted. If you think the system is messed up, why not create a new one? We are in business to make exponential returns which means taking bets on companies taking large swings at the bat. I’m only interested in the big swings.

A great example of a company in the portfolio that I’ve invested in that speaks to this is Mira. Healthcare insurance is so expensive for so many that it is no longer available to provide preventative services for many people. So Mira built an entirely new system that does not rely on healthcare insurance to offer preventative services for many who previously had no other options.

When you decide to enable the status quo, instead of disrupt it, you are asking outsiders to invest in the status quo. And you are also investing in a system that has a capped outcome of returns. When you are disrupting the system, you provide an opportunity to the long-tail consumer to tap into exponential wealth instead of just a capped take rate, or rent, that was extracted from (and relies on) an imperfect system.

If you want to go deeper on this topic, another place to start is Meera Clark’s recent post on Identity Aligned Interventions. I loved how what she wrote spoke to the importance of building better systems from the ground up can decrease costs and improve outcomes.

2) How does what you’re building fit into its historical context?

This leads us well into the second point. When you are building for the long-tail, history is your friend. Because the communities you are targeting have long been exploited, there is unfortunately a long history of distrust.

According to Pew Research Center, people in the long tail generally have lower levels of personal trust than other Americans.

So when you are building something that is supposed to help this community, you are building something that is speaking in concert with that history. A company that I think does this well is Loop. The co-founders talk openly about how legacy auto insurance has been created to discriminate against people for silly things like not being married. So they built a new insurance company from scratch. Another company in the portfolio that I think does this well is Guava. Kelly, the founder, has spent years studying how legacy financial products have disenfranchised Black small business owners and so she decided to build a new one from the ground up.

Which leads me easily into the next point...

3) Has the founder built significant empathy for the core user?

Who is selling is just as important as what you're selling. How have you incorporated people from the communities you hope to serve into your leadership team? If you haven't, how do you expect people from the communities you hope to serve to trust you? The leadership team must reflect the demographics of the communities you are selling to. Due to the historical distrust and general savviness of who you are selling to, the sale needs to be based more on a true relationship, not just an advertisement. Google and Facebook ads aren't going to work here. The marketing strategy needs to look more like Stacey Abrams' Fair Fight Campaign in GA and less like a retargeting campaign.

I remember when I was an intern at Kimberly Clark. I worked on their toilet paper brand and spent basically the entire summer interviewing different people in each department. I remember when I spoke to a sales representative who did in-person store-to-store sales and reviewed his deck. He openly shared that the brand manager teams were not a fan of his deck, but it didn't matter because he wasn't selling toilet paper to brand manager teams. He was selling it to small business owners of independent retailers. They needed to hear a different message. I think so much of that story applies here. Know who your customer is and figure out how to meet them where they are. Your customers are not VCs or other tech people, so don't build for them.

Jimmy at Providers is a great example of someone who has done this well. I interviewed him almost 4 years ago and was impressed with how genuinely curious and humble he was when interviewing and learning from his consumer. It led him to build a truly magnificent company that I’ve been really impressed with since his early days.

I hope this is helpful context of how I think about the long-tail companies I diligence. If you are an investor in companies here, I'd love to hear how you think about your diligence process! Please e-mail me at sydney@precursorvc.com. I plan to do additional posts on this topic and would love to feature you.

Thank you Nicole Jarbo, Austin Clements, Jennifer Richard & Marina Girgis who reviewed and offered feedback on earlier versions of this article. Thank you also to Cindy Heredia who created the beautiful image I used at the top of the article.

https://hbr.org/2002/04/wealth-happens

"Having cousins is a stand-in for culture, of course. It could be something else, like “…people who know someone who owes a cash-checking spot money.” But I like cousins. It captures something at the intersection of race, ethnicity, nationality, citizenship, class, and identity.” - Tressie McMillan Cottom in her substack essaying

Sydney Paige, I loved reading this post. It’s you — honest, smart, empathetic. Lucky to have you in this space, investing in companies that will matter in the future (and I mean really matter…for the right reasons).

Thanks for giving such an insightful look into your process. Real innovation should seek to eliminate pain points for a broader set of people in society, not just make it a little easier them to keep dealing with the pain. Based on your framing, I believe I know a few founders (but one in particular) who you will also want to know. Looking forward to catching up soon!